Roth Conversions In Retirement

A conversion to a Roth IRA results in taxation of any untaxed amounts in the traditional IRA. 1 While you cant contribute to a Roth IRA if your.

How To Access Retirement Funds Early

Transfer money from a.

Roth conversions in retirement. The conversion is reported on Form 8606 PDF Nondeductible IRAs. See Publication 590-A Contributions to Individual Retirement Arrangements IRAs for more information. Estate tax rates are high so this benefit can be valuable in those cases where it applies.

And the best opportunity to control your. Its the financial advisers job to protect and preserve their clients retirement funds. They are done by rolling over pre-tax always taxable funds from a retirement account into Roth never taxable one thus paying taxes at your marginal rate the year of conversion.

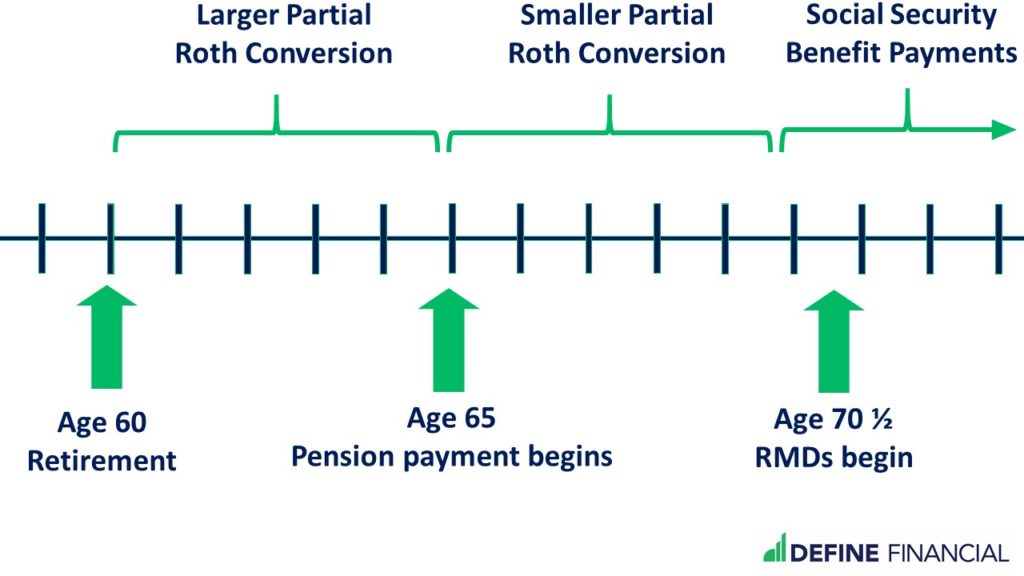

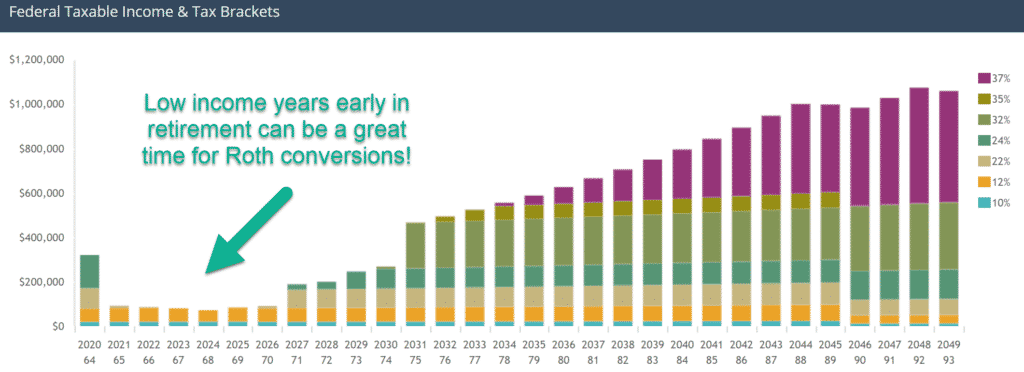

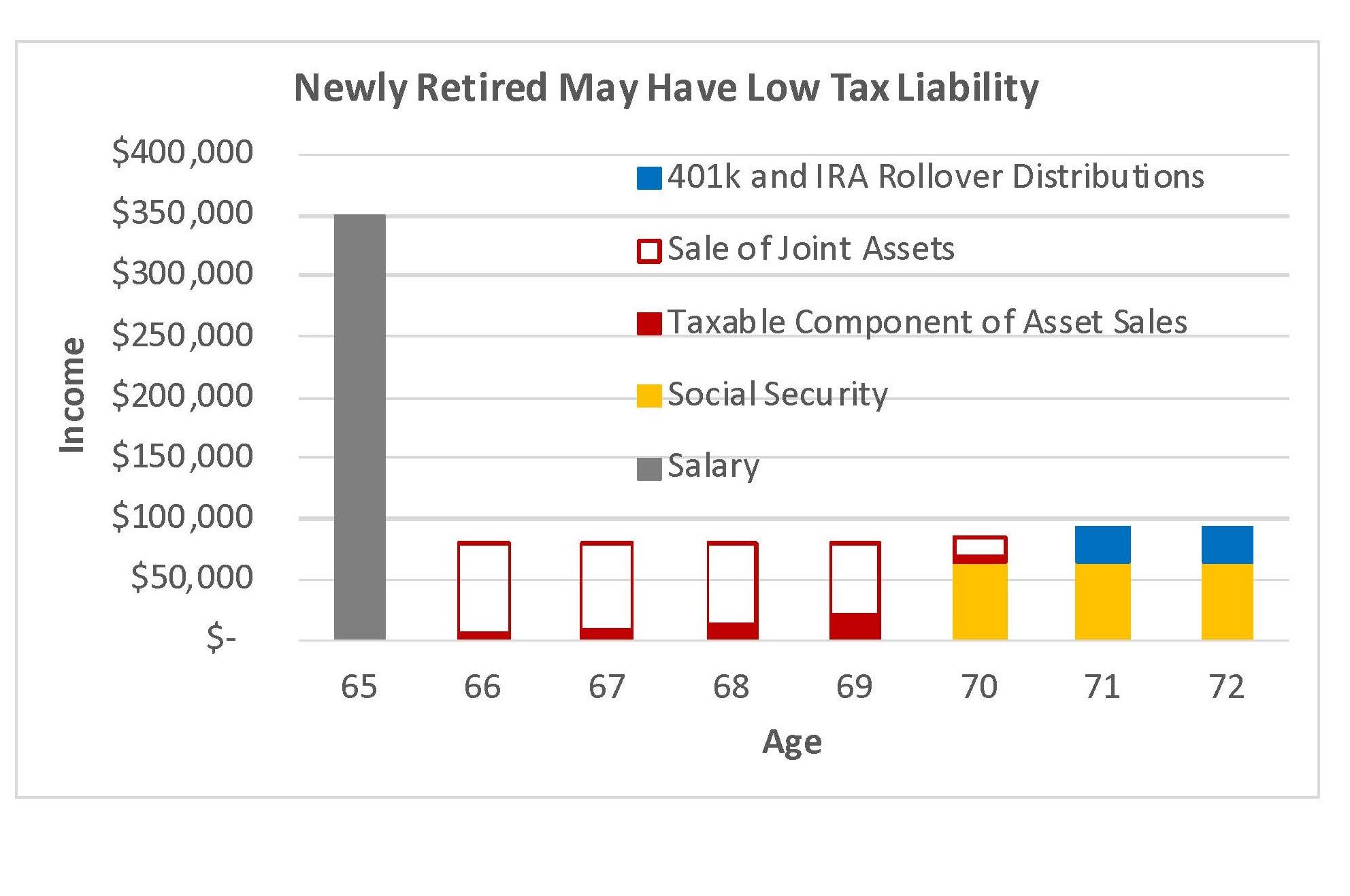

You strategically fill up lower tax brackets in order to avoid seeing Required Minimum Distributions drive you into higher tax brackets while in retirement. A Roth IRA conversion means you pay tax on your savings in the year you move your money from the traditional retirement account to the Roth in. By doing some financial planning this one move is allowing us to access money in our pre-tax retirement accounts with no penalty and the ability to pay little to no tax when it happens.

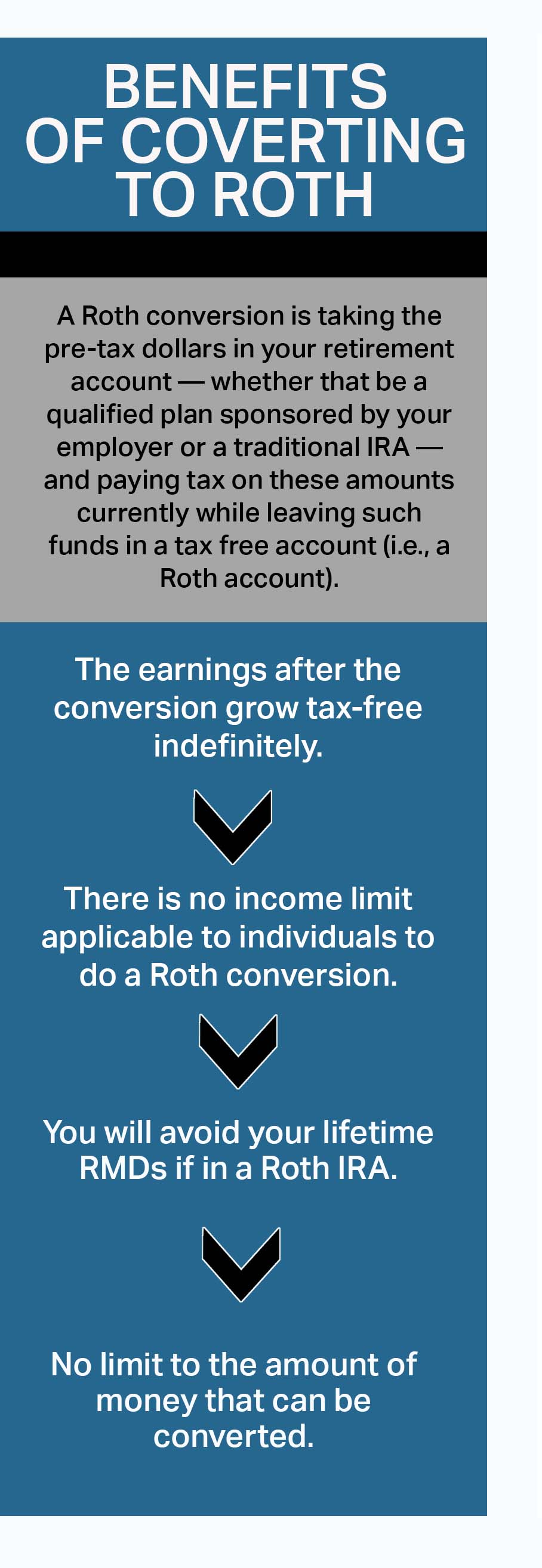

Roth IRA conversions are an excellent tool for optimizing after-tax income throughout retirement when done strategically as part of a holistic retirement income plan. The main advantage of a Roth IRA unlike a traditional IRA is that you wont have to pay income tax on the money you withdraw in retirement. If you have a traditional individual retirement account or IRA you may have considered converting to a Roth IRA.

Saving taxes is a big driver of the strategy. Doing a Roth conversion can be the key to a successful FIRE financial independence retire early strategy. With a conversion investors are able to move money out of a traditional IRA pay taxes on the funds at ordinary federal and state rates and move it into the Roth where it will grow tax-free.

By doing so you take money that is currently treated as tax-deferred and convert it into an account that grows tax-free. If youve accumulated enough wealth to be concerned with the estate tax a conversion to a Roth IRA may provide an added advantage. In our first video on pre-retirement Roth Conversions we talked about what Roth Conversions are and why you might want to do them.

Roth conversions are a winning tax move considering possible tax law changes coming. However any future gains will grow tax free. When you do this you will need to pay taxes on the money you withdraw.

If they do. This converts the money into Roth money. What is a Roth Conversion.

Ultimately Roth conversions and direct contributions for that matter are about controlling your tax rate. Roth Conversions are an important and powerful tool to control future taxes and optimize your legacy. A Roth conversion is when you take money that you have in a traditional 401k or IRA account and move it into a Roth 401k or IRA.

Roth conversions are when you move money from a traditional retirement account into a Roth account. Youll have to pay income tax on the amount converted at your marginal rate but specifically with conversions you can avoid the 10 early withdrawal penalty. In Part 2 of our series on Roth Conversions.

Ordinarily retirees who are 72 or older cant convert money in a traditional IRA or other tax-deferred accounts to a Roth until theyve taken their RMDswhich could result in a hefty tax bill. The income tax you pay on the conversion reduces the size of your taxable estate which may reduce the estate tax without reducing the value of what you leave to your heirs. There are a few different types of Roth conversion.

Retirement Taxes - Roth Conversions - Real World Case Study - YouTube. Thats definitely the case for us. A Roth conversion is an optional decision to change an existing qualified retirement plan such as a 401 k or a traditional IRA to a Roth IRA.

What Is a Roth Conversion. Roth IRA conversions are. Roth conversions are simply moving money from a tax-deferred retirement account such as a 401k 403b or traditional IRA into a Roth IRA.

Systematic Partial Roth Conversions Recharacterizations

Systematic Partial Roth Conversions Recharacterizations

Roth Conversion Ladder The Ultimate Key To Early Retirement

Roth Conversion Ladder The Ultimate Key To Early Retirement

2010 The Year Of The Roth Conversion

2010 The Year Of The Roth Conversion

Step By Step How To Lower Taxes In Retirement Define Financial

Step By Step How To Lower Taxes In Retirement Define Financial

Harvesting Capital Gains Vs Roth Conversions At 0 Tax Rates

Harvesting Capital Gains Vs Roth Conversions At 0 Tax Rates

Roth Ira Conversion What To Know Before Converting Fidelity

Roth Ira Conversion What To Know Before Converting Fidelity

Build A Roth Ira Conversion Ladder To Minimize Taxes In Early Retirement Retire By 40

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Guide To Roth Conversions Why When And How Much To Convert

Guide To Roth Conversions Why When And How Much To Convert

The Roth Conversion In Early Retirement Seeking Alpha

The Roth Conversion In Early Retirement Seeking Alpha

Should You Convert Retirement Account To A Roth Account During The Covid 19 Pandemic

Should You Convert Retirement Account To A Roth Account During The Covid 19 Pandemic

How To Access Retirement Funds Early

How To Access Retirement Funds Early

Isolating Ira Basis For More Tax Efficient Roth Ira Conversions Financial Planning

Isolating Ira Basis For More Tax Efficient Roth Ira Conversions Financial Planning

Comments

Post a Comment