How Long Does It Take For Federal Tax Return

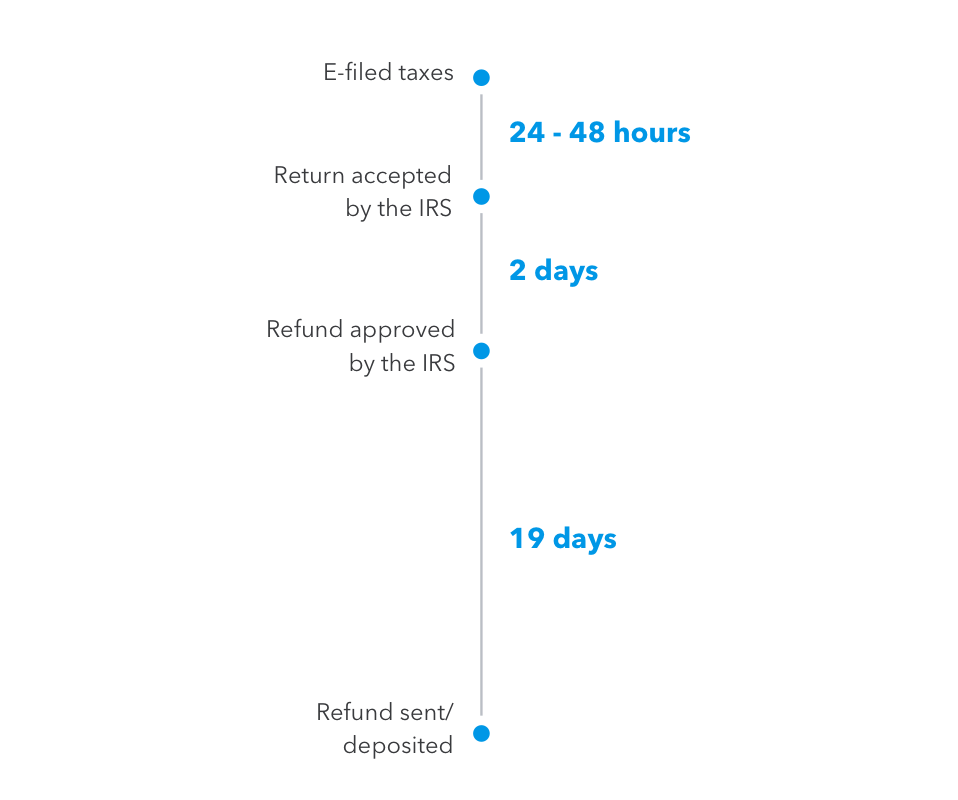

If you e-filed your taxes online you have the option of getting your refund deposited directly into your account. When it comes to filing a federal tax return there are a few questions that people care about more than any other how much tax will I pay how much will I get back in my tax refund and when will I receive it.

2018 Irs Income Tax Refund Chart When Will I Get My Tax Refund Cpa Practice Advisor

2018 Irs Income Tax Refund Chart When Will I Get My Tax Refund Cpa Practice Advisor

9 out of 10 e-filed tax returns with direct deposit will be processed within 21 days of IRS e-file acceptance.

How long does it take for federal tax return. Federal tax refund delivery time. The IRS and tax professionals strongly. Once you file the return and the IRS accepts your return it will generally take you 7-10 days to get your income tax refund if you use direct deposit and file your return.

Your return needs further review. Your return includes Form 8379 PDF injured spouse allocation -- this could take 14 weeks to process. The fastest option is to e-file your return and to receive your refund via direct deposit.

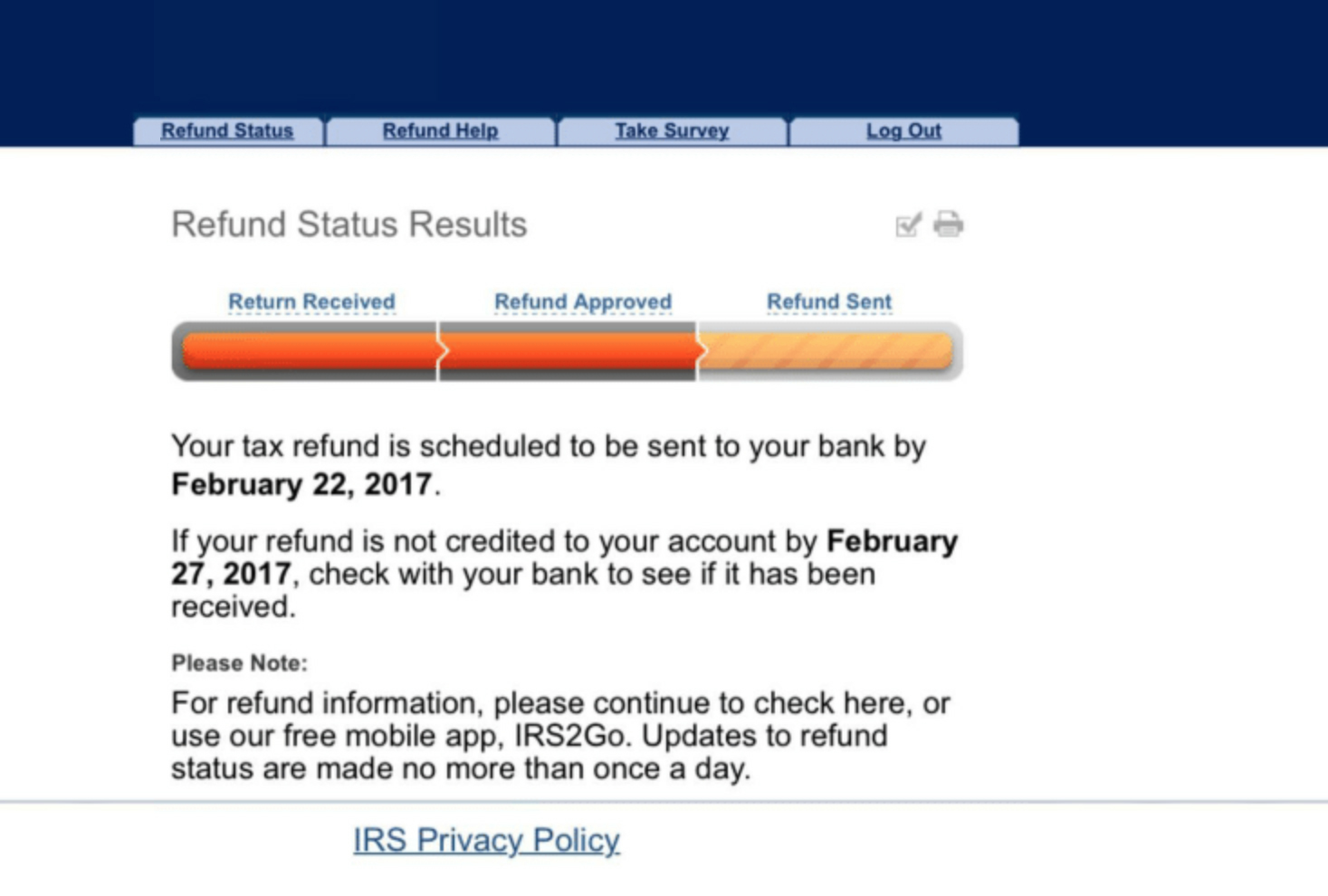

Everything you need to know to find out when your money will arrive from the IRS or why its taking so long. Your 21 day average starts from this point - so you can usually expect your tax refund the last week of February or first week of March. Weve based these timelines on historical data noting that m ost refunds will be issued by the IRS in less than 21 days after the return has been accepted.

That means your bank will have your refund within three. Delivery type Delivery time date filed receipt of tax refund Source. Heres how long it will take to get your 2019 tax refund.

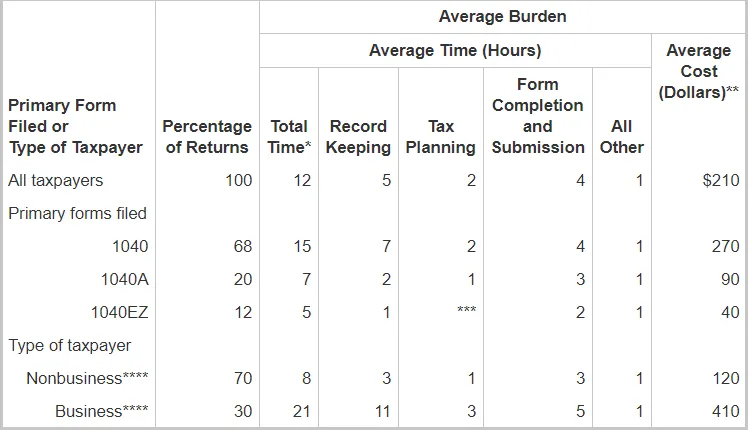

The answer varies from eight days to two months depending on how you file and choose to receive your refund. Its also important to note there might be delays due to limitations caused by the Covid-19 pandemic especially for. E-file with direct deposit.

For 2020 taxes the majority of taxpayers who choose this option will receive their refunds within 21 days. If you requested a refund of tax withheld on a Form 1042-S by filing a Form 1040NR we will need additional time to process the return. Do you want to know the answer to Federal tax refund how long does it take.

As you might expect every state does things a little differently when it comes to issuing tax refund. If you filed a paper tax return it may take as many as 12 weeks for your refund to arrive. What weve covered so far applies to federal tax refunds.

How long does it take to process a return sent by mail. What About My State Tax Refund. Everything else as they say is just details.

Paper file with a paper check 6 to 8 weeks. The IRS announced that they will automatically move the federal tax filing deadline from April 15 to May 17 giving taxpayers an additional month to file and pay 2020 income taxes. Generally you can expect to receive your state tax refund within 30 days if you filed your tax return electronically.

Almost 90 of tax refunds are processed and issued within 21 days. The federal IRS refund schedule table below is only for electronically filed returns. This is the fastest way to get your federal tax refund.

You should only call if it has been. If youre anticipating receiving a tax refund youre likely wondering how long it takes to receive your money. If you filed your tax return on paper through the mail you can.

Expect delays if you mailed a paper return or had to respond to an IRS inquiry about your e-filed return. Federal Tax Refund How Long Does it Take. If you mailed your tax return allow twelve weeks for processing then your 21 day period starts once your tax return is in the IRS system.

Most refunds will be issued in less than 21 days as long as the return doesnt require further review according to the Internal Revenue Service. While the IRS promises to have regular return refunds processed within 21 days for nine out of ten tax payers it does take quite a bit longer to receive a refund if you amended your tax return. 21 days or more since you e-filed Wheres My Refund tells you to contact the IRS.

However it can take up to 21. In the meantime keep an eye on your bank account if you still dont see the debit 7-10 days after your return has been accepted call IRS e-file Payment Services at 1-888-353-4537 or contact your state tax agency as appropriate. Paper file with direct deposit.

If you submit on the tax deadline in April you can expect your refund in the first half of May in 2021. For paper filers this can take much longer however. Generally you will have to wait 8 to 12 weeks more for the IRS to process amended returns since they prioritize.

Please allow up to 6 months from the original due date of the 1040NR return or the date you actually filed the 1040NR whichever is later to receive any refund due. Refund information will typically be available. Do not file a second tax return.

In general the IRS says that returns with refunds are processed and payments issued within 21 days.

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

2021 Irs Tax Refund Schedule Direct Deposit Dates 2020 Tax Year

2021 Irs Tax Refund Schedule Direct Deposit Dates 2020 Tax Year

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Tax Refund Schedule 2021 How Long It Takes To Get Your Tax Refund Bankrate

Tax Refund Schedule 2021 How Long It Takes To Get Your Tax Refund Bankrate

How Long Does It Take To Get My 2020 Irs Income Tax Refund Cpa Practice Advisor

How Long Does It Take To Get My 2020 Irs Income Tax Refund Cpa Practice Advisor

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

Https Www Irs Gov Pub Irs News At 01 48 Pdf

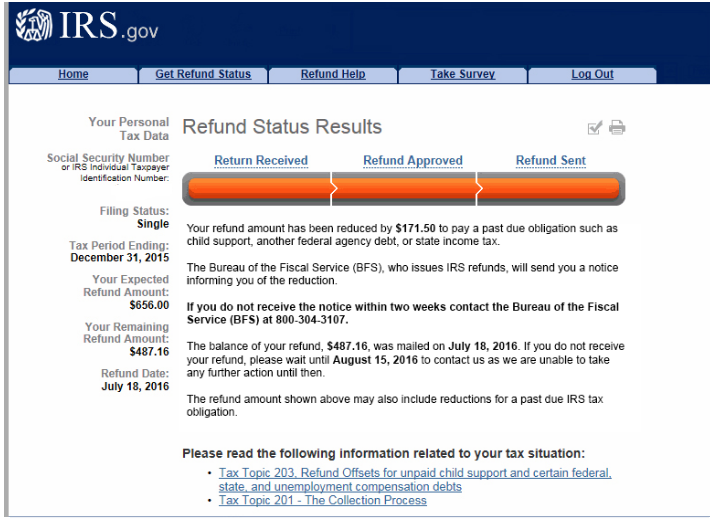

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

When Can You File Your Taxes This Year Hint It S Very Soon Kiplinger

When Can You File Your Taxes This Year Hint It S Very Soon Kiplinger

Where S My Refund Tax Refund Tracking Guide From Turbotax

Where S My Refund Tax Refund Tracking Guide From Turbotax

2021 Irs Tax Refund Schedule When Will I Get My Tax Refund Smartasset

2021 Irs Tax Refund Schedule When Will I Get My Tax Refund Smartasset

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

Comments

Post a Comment