Irs Income Tax Tables 2020

Plan ahead to lower your 2020 income taxes and lower lifetime taxes through multi-decade tax planning impacting Roth conversions the sale of major assets passing down family businesses or dealing with Required Minimum Distributions. The Tables for Withholding on Distributions of Indian Gam-ing Profits to Tribal Members.

Federal Withholding Tables 2021 Federal Income Tax

Federal Withholding Tables 2021 Federal Income Tax

For those of you who havent been familiar sufficient with the method withholding taxes are done on this year of 2020 you might learn it from Federal Tax.

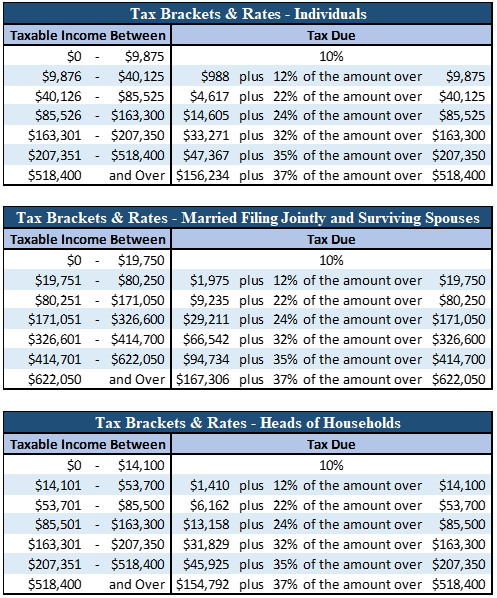

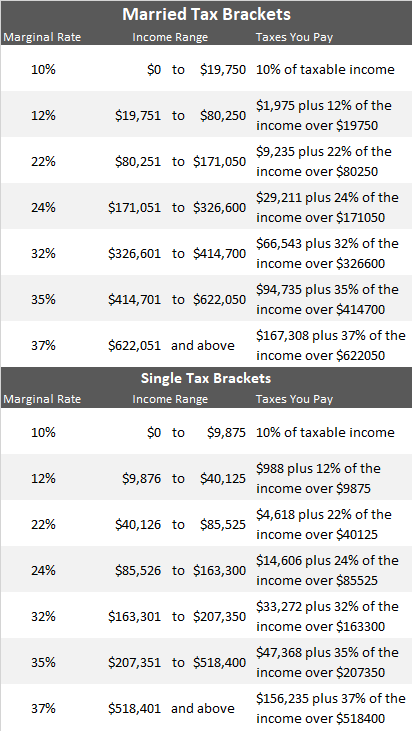

Irs income tax tables 2020. This is whats known as progressive taxation and can confuse a lot of people but an example can help illustrate how this works. For example a single taxpayer will pay 10 percent on taxable income up to 9875 earned in 2020. The rates affect just how much employee incomes or wages that you require to withhold.

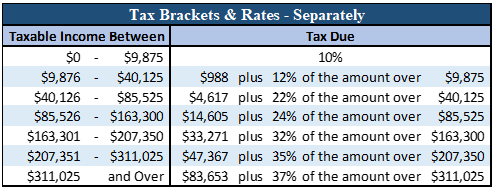

The tables include federal withholding for year 2020 income tax FICA tax Medicare tax and FUTA taxes. The amounts from Tables 1 and 2 are added to wages solely for calculating income tax withholding on the wages of the nonresident alien employee. The federal tax brackets are broken down into seven 7 taxable income groups based on your filing status.

430000 if the Form W-4 is from 2019 or earlier or if the Form W-4 is from 2020 or later and the box. Next they find the column for married filing jointly and read down the column. Your taxis 25200 25250 25300 25350 2830 2836 2842 2848.

Instructions for Schedule 3. For help with your withholding you may use the Tax Withholding Estimator. Instructions for Schedule 1.

2019 and 2020 Tax Brackets. The tax rates for 2020 are. The tax rate increases progressively the more you earn and is divided into income tax brackets.

The information you give your employer on Form W4. IRS Tax Tables 2020 If you are an employer then it is essential to recognize just how employment tax rates are measured and restored yearly. You can use the Tax Withholding Estimator to estimate your 2020 income tax.

Most taxpayers pay a maximum 15 rate but a 20 tax rate applies if your taxable income exceeds the thresholds set for the 37 ordinary tax rate. Although this publication may be used in certain situa-tions to figure federal income tax withholding on supple-. Its important to note you only have to pay the tax rate on the amount your taxable income falls into for each tax bracket.

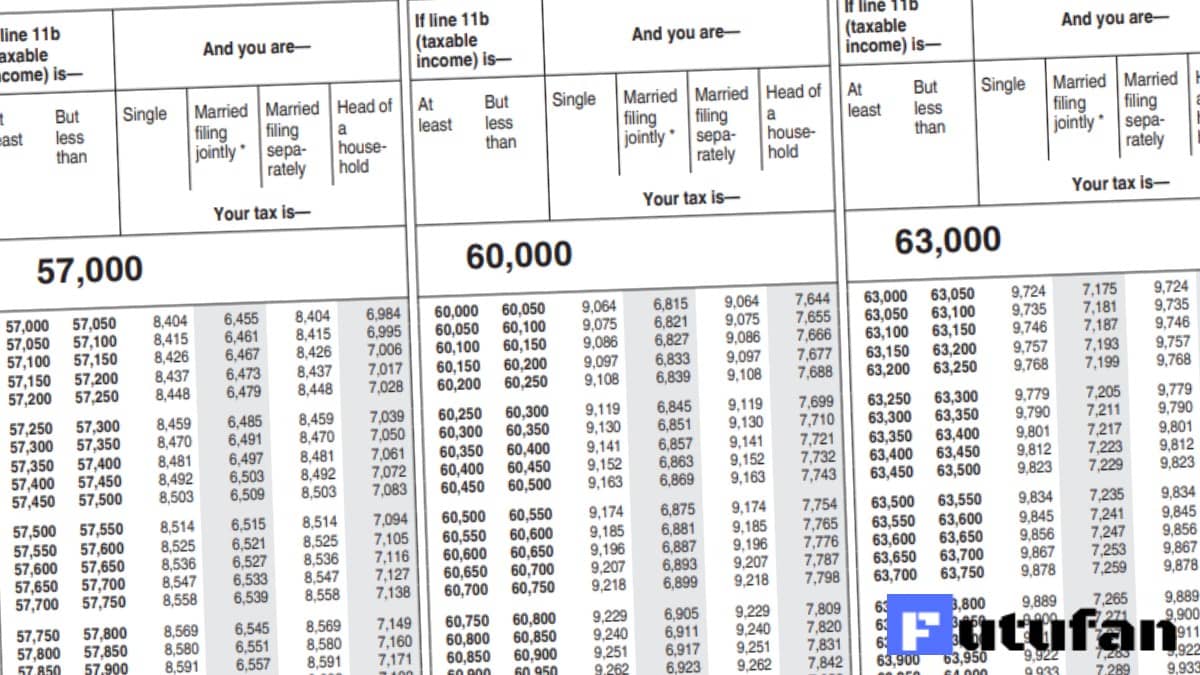

The IRS has announced the 2020 income tax tables and other adjustments for inflation. You may also use the In-come Tax Withholding Assistant for Employers at IRSgovITWA to help you figure federal income tax with-holding. First they find the 2530025350 taxable income line.

For more information see the instructions for Forms 1040 and 1040-SR line 28. 2020 Federal Tax Tables The Inland Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4. The amounts from the tables shouldnt be included in any box on the employees Form W-2 and dont increase the income tax liability of the employee.

The top tax rate is 37 percent for taxable income above 518400 for tax year. Also the amounts from the tables dont increase the social security tax or Medicare tax liability of the employer or the employee or the FUTA tax. This is the tax amount they should enter in the entry space on Form 1040 line 16.

These tax rate schedules are provided to help you estimate your 2019 federal income tax. For more information see the instructions for Forms 1040 and 1040-SR line 27 for more information on this elec-tion. For 2019 W-4 Deductions per dependent.

Capital Gains rates will not change for 2020 but the brackets for the rates will change. Earned income to figure your 2020 earned income credit. Find Your Federal Tax Rate Schedules.

Instructions for Schedule 2. TurboTax will apply these rates as you complete your tax return. In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

The amount shown where the taxable income line and filing status column meet is 2644. Instructions booklet 1040TT does not contain any income tax forms. Its important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate.

10 12 22 24 32 35 and 37. There are seven tax rates ranging from 10 to 37 as of 2020. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518400 and higher for single filers and 622050 and higher for married couples filing jointly.

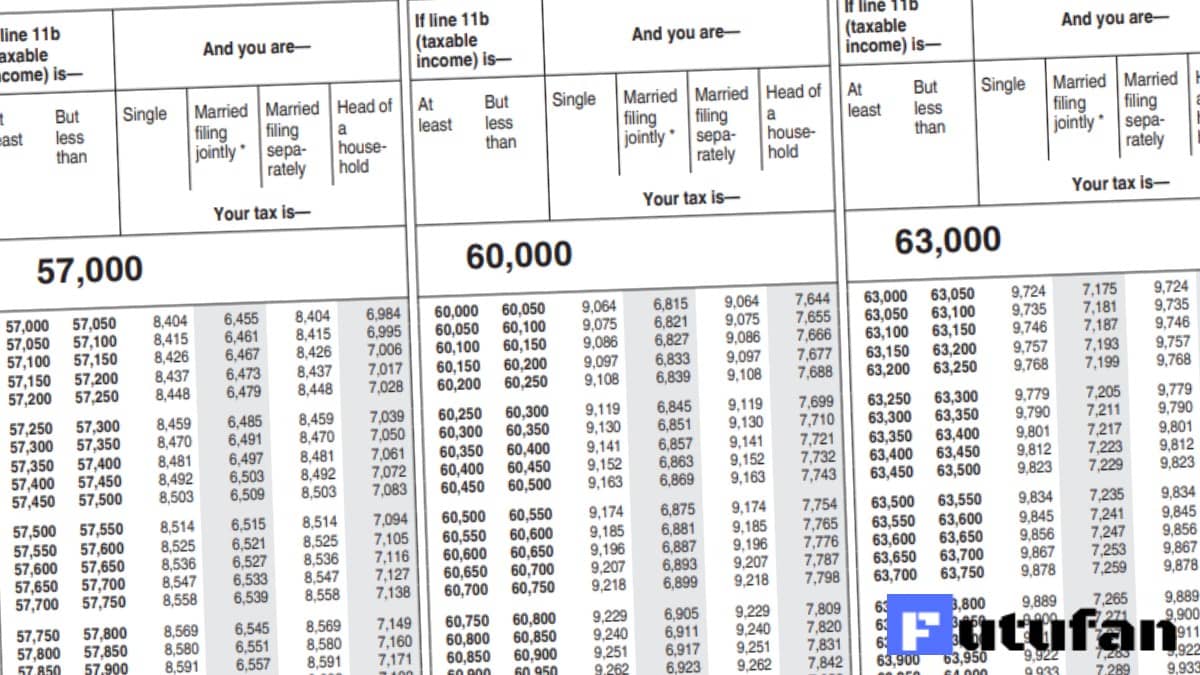

See the instructions for line 16 to see if you must use the Tax Table below to figure your tax. Total Income and Adjusted Gross Income. Capital Gains rates will not change for 2020 but the brackets for the rates will change.

Use the tables below to find your 2019 and 2020 tax brackets. Exceptions also apply for art collectibles and section 1250 gain related to. Only the money you earn within a particular bracket is.

The amount you earn. Updated for Tax Year 2020. Their taxable income on Form 1040 line 15 is 25300.

Election to use your 2019 earned income to figure your 2020 additional child tax credit. Most taxpayers pay a maximum 15 rate but a 20 tax rate applies if your taxable income exceeds the. At Least But Less Than SingleMarried ling jointly Married ling sepa-rately Head of a house-hold.

The amount of income tax your employer withholds from your regular pay depends on two things. Disclosure Privacy Act and Paperwork Reduction Act Notice. The Tax Withholding Estimator compares that estimate to your current tax.

2020 Individual Income Tax Brackets. Booklet 1040TT contains the 2020 Tax And Earned Income Credit Tables used to calculate income tax due on federal Form 1040 and Form 1040-SR. 25250 25300 25350 25400 2632 2638 2644 2650 2830 2836 2842 2848 2745 2751 2757.

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

What You Need To Know About 2020 Taxes Advisors Management Group

What You Need To Know About 2020 Taxes Advisors Management Group

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

New 2021 Irs Income Tax Brackets And Phaseouts

New 2021 Irs Income Tax Brackets And Phaseouts

Irs Tax Tables 2020 2021 Federal Tax Brackets

Irs Tax Tables 2020 2021 Federal Tax Brackets

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg) Where To Find And How To Read 1040 Tax Tables

Where To Find And How To Read 1040 Tax Tables

Comments

Post a Comment