Inherited Ira Spouse

One popular option was taking required minimum distributions. Your spouse dies and you inherit his or her IRA.

Should I Inherit My Spouses Ira Isc Financial Advisors

If the surviving spouse is less than age 59½ and might need to take distributions before reaching that age then the inherited IRA likely is the best option.

Inherited ira spouse. IRA Heirs Beware Mistakes The decision typically. Transfer the assets to an inherited IRA and take RMDs. Spousal Inherited IRA.

The surviving spouse can move the account into an inherited IRA to keep the tax shelter. For IRAs inherited prior to Jan. However keep in mind that these larger distributions could push you into a higher tax bracket.

Treat it as his or her own by rolling it over into a traditional IRA or to the extent it is taxable into a. Tax-wise the new IRA recipient is subject to the same tax rules that any IRA holder would be. If you were gifted a traditional IRA by a spouse you can roll its funds into any existing IRA you own.

When the Secure Act passed in December 2019 it completely changed the way some beneficiaries are allowed to withdraw from inherited IRAs. Putting it into their name or rolling it over into another IRA they already have. Treat it as his or her own IRA by designating himself or herself as the account owner.

The Secure Act made several changes to when funds from these inherited IRAs have to be distributed. Your options for taking distributions from the IRA are based on when the original IRA owner died. Treat the IRA as.

Or she can choose to roll the account into her own IRA. 1 2020 non-spousal beneficiaries had several options for taking distributions from the account. Many farmers will inherit an IRA from a spouse or relative during their lifetime.

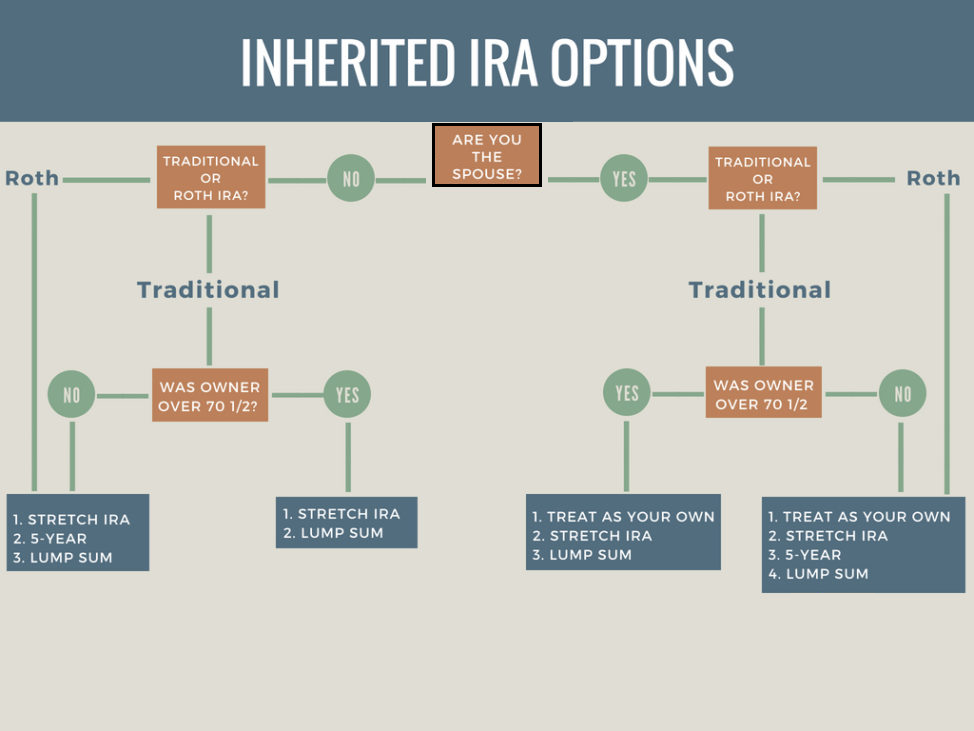

If you inherit a Traditional Rollover SEP or SIMPLE IRA from a spouse you have several options depending on whether your spouse was under or over age 70½. Prior to the law non-spouse. If you take those.

The money will continue grow on a tax-deferred basis. If your spouse the account holder was under 70½ these are your. If a traditional IRA is inherited from a spouse the surviving spouse generally has the following three choices.

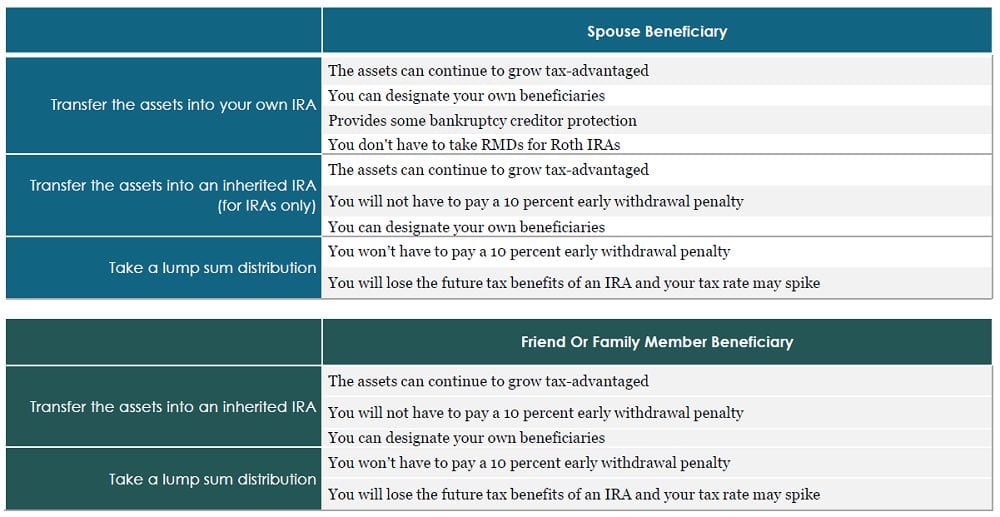

Most commonly those who inherit an IRA from a spouse transfer the funds to their own IRA. From a tax perspective what is the best way to handle that. An inherited IRA is an account that is opened when an individual inherits an IRA or employer-sponsored retirement plan after the original owner dies.

You cant contribute money to an inherited IRA -- unless of course youre a spouse who rolled over an inherited IRA into your own IRA. Spouses are the only beneficiaries who have the option to rollover the IRA into an IRA titled in their own name. IRA Inheritance From a Spouse.

We asked Bruce Bell an attorney at the Chicago. A spousal IRA means you have lost a spouse and they designated you as a. When the surviving spouse.

The most common type of inherited IRA is the spousal IRA. The individual inheriting the Individual. Spouses can set up an Inherited IRA.

As long as your spouse was under age 72 when they died you can withdraw inherited assets from an inherited IRA at any time as long as the amount meets or exceeds the amount you are required to withdraw as a beneficiary. Youll have to pay taxes on any distributions taken out of the account at current income tax rates. The flexibility to treat the decedents IRA as your own gives you ultimate discretion with the IRA.

When a traditional IRA is transferred into an inherited IRA sometimes also referred to as a beneficiary distribution account there are RMD rules to follow set by the IRS. A surviving spouse has the most flexibility with an inherited IRA. Treat the IRA as if it were your own naming yourself as the owner.

If someone inherits an IRA from their deceased spouse the survivor has several choices for what to do with it. If you inherit IRA assets from someone other than your spouse you have several options. And not get sucked dry by taxes.

But its usually more advantageous to treat the deceaseds IRA as their own.

Non Spouse Beneficiaries Rules For An Inherited 401k

Non Spouse Beneficiaries Rules For An Inherited 401k

Making Sense Of Inherited Iras Mpm Wealth Advisors

Spousal Rollover Rules For Inherited Roth Traditional Iras

Spousal Rollover Rules For Inherited Roth Traditional Iras

New Secure Act Stretch Ira Rules For Eligible Designated Beneficiaries

New Secure Act Stretch Ira Rules For Eligible Designated Beneficiaries

Inherited Ira Rules Before And After The Secure Act Aaii

Inherited Ira Rules Before And After The Secure Act Aaii

Spousal Rollover Rules For Inherited Roth Traditional Iras

Spousal Rollover Rules For Inherited Roth Traditional Iras

Spousal Rollover Rules For Inherited Roth Traditional Iras

Spousal Rollover Rules For Inherited Roth Traditional Iras

Inheriting An Ira Here S What To Do Next Brighton Jones

Inheriting An Ira Here S What To Do Next Brighton Jones

Inherited Ira Rules Before And After The Secure Act Aaii

Inherited Ira Rules Before And After The Secure Act Aaii

Inheriting An Ira Here Are All The Options And Withdrawal Rules Beneficiaries Should Know

Inheriting An Ira Here Are All The Options And Withdrawal Rules Beneficiaries Should Know

Spousal Traditional Ira Give Out Your Partner A Upwards

Spousal Traditional Ira Give Out Your Partner A Upwards

The Beauty Of The Inherited Ira Resilient Asset Management

The Beauty Of The Inherited Ira Resilient Asset Management

Spousal Beneficiary Options For Inherited Iras And Roth Iras

Spousal Beneficiary Options For Inherited Iras And Roth Iras

Inheriting An Ira From Your Spouse Know Your Options New Century Investments

Inheriting An Ira From Your Spouse Know Your Options New Century Investments

Comments

Post a Comment