Does Venmo Charge A Fee To Send Money

Fees associated with Venmo. If you make a payment for an amount that is equal to or less than the amount in your Venmo balance itll be fully funded by.

Venmo Money Transfer App Reviews Security Venmo Fees

Venmo Money Transfer App Reviews Security Venmo Fees

These are available within 30 minutes but Venmo charges a 1 percent fee on the transaction.

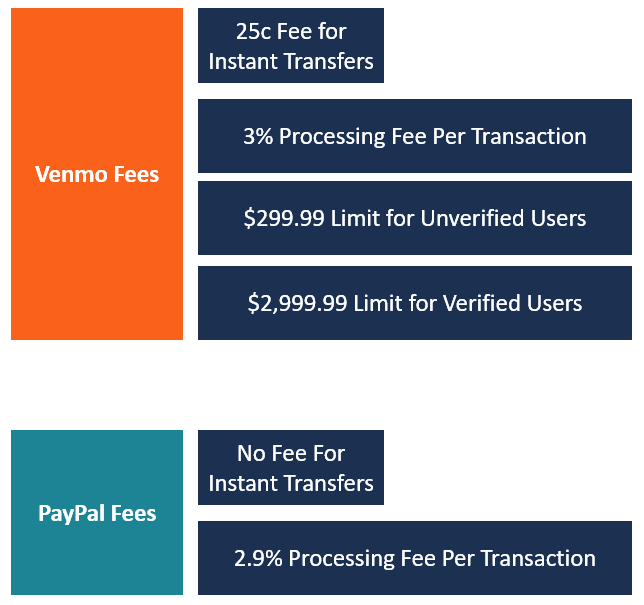

Does venmo charge a fee to send money. However there are no charges for sending people money using the Venmo balance debit card or bank account. Venmo charges a three percent fee to send money from your credit card though if you only use your Venmo balance or bank account to send money there are no fees. If you have access to a Venmo balance any payments you receive from friends will be added to your Venmo balance and you can use those funds to make payments.

Venmo launched a platform with an integrated social network in 2012. Venmo doesnt charge for basic services like. Normal bank transfers take.

Some credit card providers charge cash advance fees possibly including an additional dollar amount or percent rate in addition to other possible cash advance service fees including a higher APR if you use your credit card to make payments to friends on Venmo. For more information about whether your card provider charges these fees contact your card provider. Receivingwithdrawing money into your Venmo account or using our standard transfer to your bank account.

If you want to receive your money faster you can opt for an instant transfer. Sending money over Venmo triggers a standard 3 fee but the company waives that expense when the transaction is. Venmo is a free app for iOS and Android to send and receive money to anyoneAll you need is a bank account or credit or debit card.

Sending money from a linked bank account debit card or your Venmo balance. Theres a fee for sending money to people using your credit card. Do I need to add money to Venmo to pay someone.

The only time Venmo charges the user a fee is when you choose instant transfer. Venmo charges 3 per transaction for purchases made with a credit card and no fee for debit card purchases. Sending money to people using your credit card 3.

Venmo also has NO monthly or annual fees. No fee to send money to people using your. Today I explain how Venmo makes money and whether or not there are truly any fees associated with VenmoThe truth is that sending and receiving money is free.

Venmo charges a three percent fee to send money from your credit card though if you only use your Venmo balance or bank account to send money there are no fees. Theres still a free option but its not as fast. The Venmo fees are one percent with a maximum fee of 10.

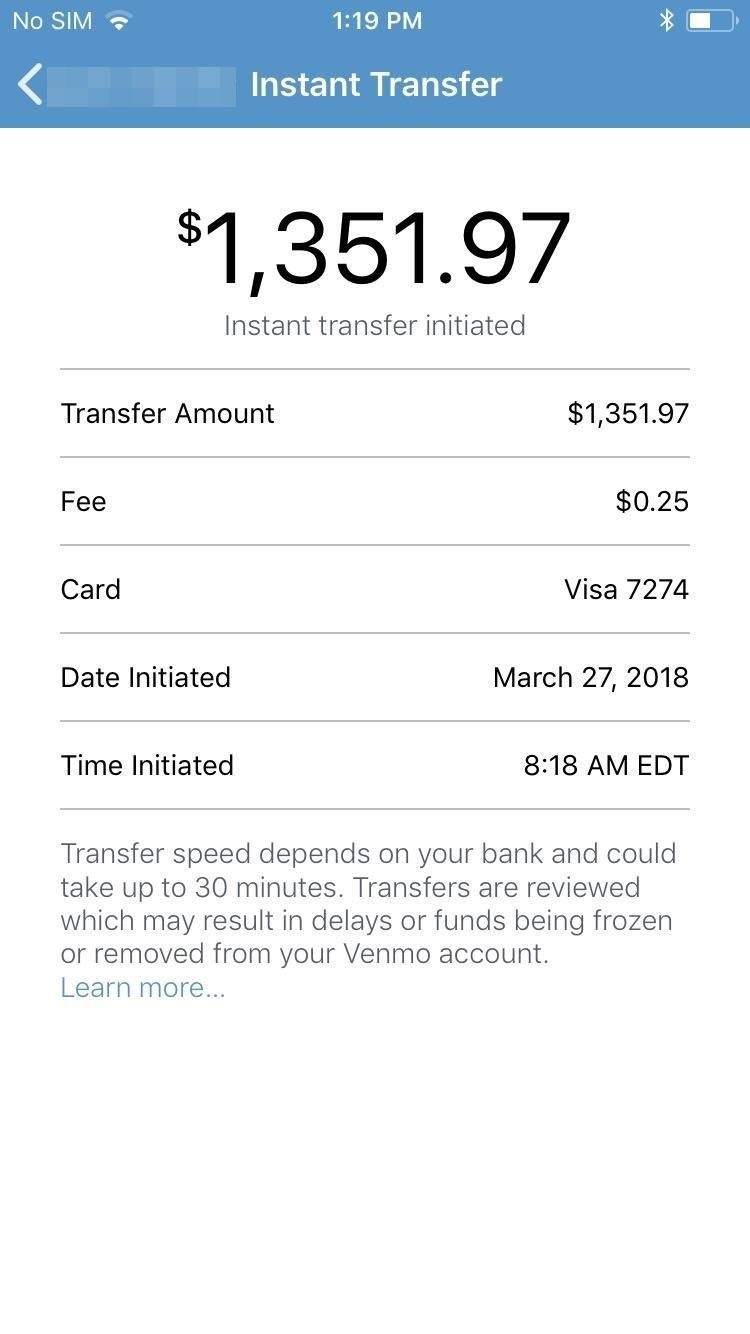

Venmo is obviously meant to be used for everyday. Should you want to avail of the instant transfer option either towards your Bank or Cash App Account Venmo will charge 1 per transaction with a minimum 025 transaction fee. Instant transfers If you transfer money from Venmo into your bank account and want to have access to the money within 30 minutes it costs a flat fee of 1 or a minimum of 25 cents of the transaction.

The instant transfer can take up to half an hour to reflect. You can also apply for a. Sending money to people using your balancedebit cardbank 000.

Once people have sent money to your Venmo account there are two different ways to transfer it to your bank account. Also Venmo charges you a 1 minimum 025 fee maximum 10 fee when transferring money from your Venmo account to your eligible linked debit card or bank account when you use the Instant Transfer option. Through these two methods Venmo will not charge a fee when transferring your balance to your bank account if you opt to wait 1-3 Business Days.

Venmos current worth. No fee for online purchases. You dont need to add money to Venmo to make payments.

A standard transfer is free but takes one to three business days. 38 Billion According to BusinessWire a high-end financial platform informs Venmo currently has over 2 Million merchants signed-up for business purposes. Meaning Venmo makes money by charging these 2 million merchants a 3 standard fee over every Venmo transaction money received from customers.

Venmo recently added an option to instantly send money to your debit card for 25 cents. Although neither service charges to transfer money to a connected bank account with a standard turnaround one to three business days for Venmo and one to two business days for PayPal Both services charge a 1 fee with a maximum of 10 for an instant transfer.

Does Venmo Charge A Fee A Guide To Venmo Fees And How To Avoid Them

Does Venmo Charge A Fee A Guide To Venmo Fees And How To Avoid Them

Venmo Guide For Beginners Nextadvisor With Time

Venmo Guide For Beginners Nextadvisor With Time

/how-safe-venmo-and-why-it-free_FINAL-5c7d732a46e0fb00018bd86c.png) How Safe Is Venmo And Is It Free

How Safe Is Venmo And Is It Free

Venmo 101 The Fees Limits Fine Print You Need To Know About Smartphones Gadget Hacks

Venmo 101 The Fees Limits Fine Print You Need To Know About Smartphones Gadget Hacks

Does Venmo Charge A Fee A Guide To Venmo Fees And How To Avoid Them

Does Venmo Charge A Fee A Guide To Venmo Fees And How To Avoid Them

/cdn.vox-cdn.com/uploads/chorus_asset/file/10103319/venmo_instant_transfer.png) Venmo Can Now Instantly Transfer Money To Your Debit Card For 25 Cents The Verge

Venmo Can Now Instantly Transfer Money To Your Debit Card For 25 Cents The Verge

Venmo Overview How It Works Fees And Transaction Limits

Venmo Overview How It Works Fees And Transaction Limits

Here S Why You Should Stop Using Venmo And Start Using Facebook Messenger For Paying Back Your Friends

Here S Why You Should Stop Using Venmo And Start Using Facebook Messenger For Paying Back Your Friends

Does Venmo Charge A Fee Simple Thrifty Living

Does Venmo Charge A Fee Simple Thrifty Living

Venmo 101 The Fees Limits Fine Print You Need To Know About Smartphones Gadget Hacks

Venmo 101 The Fees Limits Fine Print You Need To Know About Smartphones Gadget Hacks

Why You Should Use Facebook Messenger Instead Of Venmo To Pay Back Friends

How Venmo Works And What To Know Before You Use It Marketwatch

How Venmo Works And What To Know Before You Use It Marketwatch

Venmo Launches Instant Transfers To Bank Accounts Techcrunch

Venmo Launches Instant Transfers To Bank Accounts Techcrunch

:max_bytes(150000):strip_icc()/001-venmo-instant-transfer-not-working-4583914-1d165def59854046804bffc86c03c45e.jpg) Venmo Instant Transfer Not Working Here S What To Do

Venmo Instant Transfer Not Working Here S What To Do

Comments

Post a Comment